Post-Brexit UK…. a tax haven?

The post-Brexit UK is already a tax haven!

The United Kingdom needs no introduction: it’s an entrepreneur’s paradise.

For several decades, it has been the preferred jurisdiction for investors, VSEs and SMEs, because there’s a great entrepreneurial culture, company law in the UK and more specifically in London is flexible and above all, you pay less business tax, under certain conditions.

In 2016, the English voted for Brexit in a referendum. What are the consequences? For the European Union, the divorce is almost a threat, because of a certain tax attractiveness in the UK that will certainly be reinforced, so much so that the country could become a tax haven. Exploration.

What about Brexit?

On June 23, 2016, the British people voted to leave The European Union with 51.9% of the vote. The withdrawal procedure was triggered on March 29, 2017, and the exit will not be final until the night of January 31 to February 1, 2020.

Taxation

London before the Brexit was already a paradise for entrepreneurs. Corporate tax rates were already among the most advantageous in the European Union, ranking the country among the top 10 most attractive in the world.

UK corporation tax for Limited companies (equivalent to EURL, SARL) was 19%, irrespective of profit band.

Seen from this angle, England had sufficient margin to lower its tax, an advantage that will benefit from the Brexit. See more below.

The legislative framework

In addition to its tax appeal, the UK’s legislative framework is conducive to business success.

London is home to 6 to 7 million small and medium-sized businesses, the majority of which are Limited companies, whose numbers are growing every quarter and are unlikely to fall any time soon.

By comparison, Paris has 835,741 companies!

(Source http://entreprises.lefigaro.fr/paris/ville-75056)

To sum up, here are the features that make the British business environment so business-friendly :

- labor and corporate law is highly flexible; its source is legislative and not jurisprudential like much of Anglo-Saxon law;

- administering a company is easy, with no red tape;

- the company can be incorporated in a matter of hours, with no need to travel to London;

- no capital contribution required;

- there’s no call-out, and no Sécurité Sociale des Indépendants as in France.

London, a global financial center

London is the world’s second-largest financial center, just 4 points behind New York.

The City owes its excellent position to a solid infrastructure, a stable political and legal environment and an attractive tax regime.

The UK’s capital brings together a wide range of players from the stock market, financial sector, trading companies and international banks.

It is also Europe’s digital capital, and the world’s Fintech and artificial intelligence hub.

With its unrivalled economic competitiveness, more than 150,000 investors have not hesitated to relocate their businesses to this world-class jurisdiction.

After the Brexit London or the new Singapore on the Thames

On February 01, 2020, the United Kingdom officially leaves the European Union, four years after the “leave” vote.

But the Brexit is not all good news, as anti-tax-haven campaigners fear that Boris Johnson’s policies could turn the country into Singapore on the Thames, profiting from deregulation and liberalism.

Indeed, they fear that the City will give in to European regulations such as the exchange of company information.

On the other side of the Channel, our European neighbors feel threatened by the tax cuts that are sure to attract investors from all over the world.

For the British Prime Minister, “it’s the start of a new golden age”, but these words resonate as social and fiscal dumping among competitors.

This year alone, corporation tax has already been cut from 19% to 17%, yet the occupant of 10 Downing Street is already talking about reducing rates further to 15% or below for corporation tax and 7% to 15% for dividend tax by 2021.

Negotiations in the midst of transition: deal or no deal!

New negotiations concerning their future trade relations have already begun, but the dialogue has only resulted in a “no deal”.

What’s more, the Brexit also means the end of past trade agreements between the UK and its partners.

As a result, trade treaties and tax treaties signed with third countries will have to be renegotiated over the next few years.

The United Kingdom and the European Union have until the end of the year to reach agreement. Failing this, the economies of both entities, already affected by the crisis left by covid19, risk sinking even further.

The economic fallout of Brexit

The Brexit and the global health crisis are fraught with consequences for the British economy. In the second quarter of 2020, growth is estimated at minus 30%, i.e. a recession of minus 6.5%.

As for the unemployment rate, it will rise from 3.7% in 2019 to 10% by the end of 2020.

Possible consequences

The conclusion of negotiations on a no deal between London and Brussels during the transitional period could worsen the circumstances :

- given that London is the world’s 2nd largest financial center, Brussels is offering London’s clearing houses 18 months after Brexit to continue trading freely with the European Union, in order to avoid a possible stock market crash; from now on, London will retain its title as the world’s financial center solely on the basis of equivalence, if British regulation complies with European standards;

- according to the Europeans, the absence of a trade agreement risks sinking the British economy, as the country exports 47% of its products to the continent; a study has shown that the no deal could cost three times as much as the health crisis linked to the coronavirus;

- from January 1, 2021, goods will be subject to border controls between the UK and the EU, representing an additional £15 billion in administrative costs each year for both sides;

- in the absence of trade agreements, the return of customs duties; consequently, trade between the UK and the EU will be governed by the rules of the World Trade Organization; we can therefore expect a significant rise in prices for many products;

- France, Spain, the Netherlands and Denmark fear a ban on fishing in British waters: at best, British fishermen will be free to fish in their own waters without having to comply with fishing quotas like EU member states;

- if no agreement is reached, this would have an impact on the free movement of people within the European Union; as the UK is not part of the Schengen states, setting foot on British soil may require a visa as well as a work permit.

Soft Brexit or Hard Brexit?

At the end of 2020, two scenarios are possible: a soft Brexit or a hard Brexit.

- Soft Brexit is an option that allows the UK to maintain a close relationship with the European Union by remaining within the Single Market and/or the European Customs Union. This means maintaining the free movement of citizens within the European Union, submitting to the rulings of the European Court of Justice and contributing to the EU budget.

- Hard Brexit means leaving the European single market, bringing back customs duties and introducing quotas. Economic relations between the United Kingdom and the European Union will be governed solely by the rules of the World Trade Organization. To facilitate free trade agreements, the UK would leave the Single Market and the European Customs Union. Finally, a visa and/or work permit would be required in the absence of an agreement on the free movement of citizens between the UK and mainland Europe.

English confidence

Even if the fate of the British economy remains uncertain, Brexiters remain confident.

For them, leaving the European Union is an opportunity to benefit from deregulation and liberalism.

Recession is not inevitable, even if the economy is in decline; indeed, it’s part and parcel of the business cycle, in which the economy reaches its growth peak and then retracts.

The post-Brexit UK is already a tax haven, due to :

- administrative flexibility ;

- advantageous taxation;

- a legislative framework that supports entrepreneurial success.

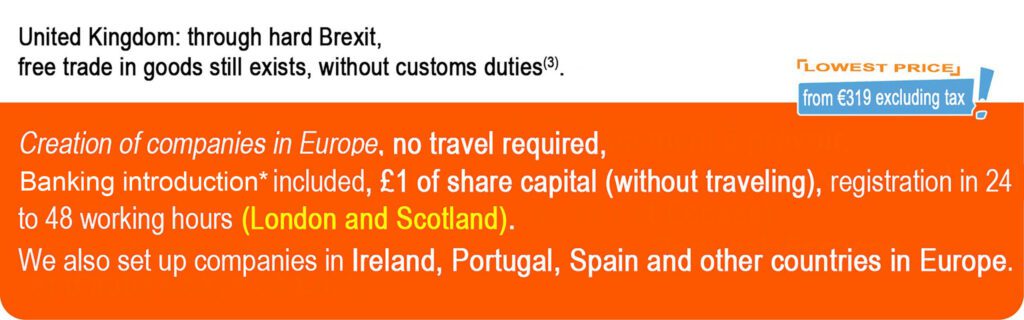

Negotiations towards a hard Brexit

The UK’s exit from the European Union confirms this image of a made-in-UK tax haven from the end of 2020.

According to estimates, negotiations on a free trade agreement have a 75% chance of leading to a hard Brexit.

The reason for this seems to be that Brussels doesn’t see the UK as a sovereign state, which tends to widen the gap with London.

For example, the European Union is demanding that fishermen from other European states be allowed to continue fishing in British territorial waters, or that London submit to European standards and competition laws.

For his part, Boris Johnson is already preparing a Hard Brexit, the soft one seems non-negotiable.

He is planning a drastic cut in corporation tax of up to 10% or 12% if no agreement is reached.

He also plans to abolish 90% of customs duties and cut VAT from 20% to 8%; what other countries see as social and fiscal dumping turns out to be a liberal strategy.

CANZUK or the new economic world order

In addition, the post-Brexit UK is also home to the CANZUK free trade zone, or the gateway for exports to countries in the Anglosphere, which includes Canada, Australia, New Zealand and the UK.

This new economic zone alone represents 15% of the world economy. These 5 sovereign nations are closely linked by free trade, common market and free movement of people agreements, the antithesis of Brussels’ many restrictions.

What’s more, 2022 will see the accession of India, followed by that of the USA in 2023.

Setting up a Limited company in London now gives you the advantage of being able to export to CANZUK member countries without any customs duties or administrative formalities whatsoever.

This international body is likely to thwart the predictions of Brexit skeptics and give the European Union stiff competition with China, even if this means the UK will have to bounce back and adapt.